South Carolina County Tiers and Per Capita Income Levels Set for 2023

2023 County Tiers Set for JTCs, Fee in Lieu and Tax Moratorium

Each year, South Carolina's 46 counties are designated as being within one of four "tiers" for job tax credit and job development credit purposes based on a county's unemployment rate and per capita income. On December 14, 2022, the SC Department of Revenue has published the 2023 designations.

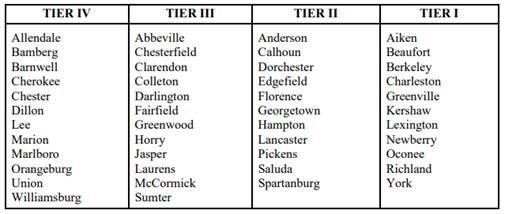

Below is a complete list of counties and their respective tiers for 2023. Interestingly, no counties changed tiers from 2022 to 2023. Further, there was no change in income tax moratorium counties (Chesterfield, Dillon, and Jasper), and no counties qualify for the reduced $1 million investment threshold for FILOT agreements.

Per Capita Income Figures

On December 14, 2022, the South Carolina Department of Revenue released Information Letter 22-24, setting forth the updated per capita income level for the state at $52,467, up from $48,021 a year earlier. Please access the link to view the county per capita income levels. The state per capita income is relevant for the small business job tax credit, in which a taxpayer with 99 or fewer employees in an eligible industry increases employment by two or more new, full-time jobs. If the average wages of those jobs do not exceed 120% of the lower of the county or state average per capita income, the credits are cut in half. Notably, if the small business creates ten or more new, full-time jobs, the business qualifies for the full amount of job tax credits without regard to wages.

In addition, the state per capita income is relevant for purposes of defining a "qualifying service-related facility," which is applicable for both job tax credits and job development credits and which has become an increasingly important avenue for non-manufacturing businesses to qualify for key South Carolina incentives. Further, the figure is relevant to technology-intensive facilities for determining eligibility for the sales and use tax exemption for computer equipment, as well as for the state income tax credit on personal property expenditures associated with corporate headquarters projects.

Finally, job development credits are usually provided only for jobs paying at or above the county per capita income level at the time the initial application is approved (and adjusted every five years thereafter). As reflected in the Information Letter linked above, many counties experienced significant increases in per capita income from 2022 to 2023.

For more information, click here to read our December 2022 Economic Development Update.

Contact Will Johnson or a member of our Economic Development team for additional information on these topics or other economic development questions.